Who is the most unsavoury lobbyist in Brussels?

Who is the most unsavoury lobbyist in Brussels?

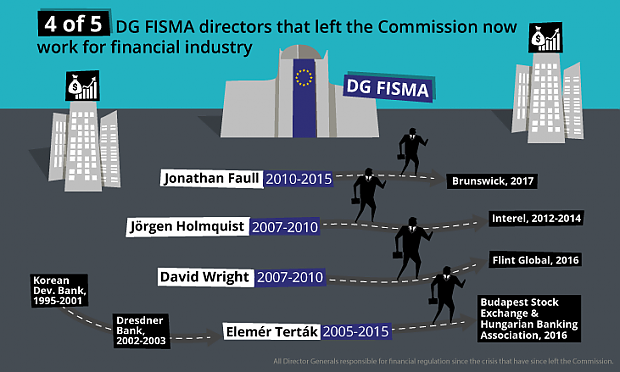

Just over two weeks ago CEO published the results of an enquiry into the links between the Commission's financial specialists and the banking world. Their findings were shocking: in the period between 2008 and 2017 a third of the top officials in the Commission's financial service were recruited from the same financial world for which they were charged with drawing up regulations, or they went into the finance industry after their period of employment as an official. Four of the five former directors, on leaving their post, went to work at financial institutions or at lobbying firms representing the interests of such firms. And further down the hierarchy you had a real revolving door. Officials took their inspiration from former Commission president José Barroso who left for Goldman Sachs, or European Commissioner Neelie Kroes, who accepted a position at Merryl Lynch. But CEO's list is a great deal longer.

In the Netherlands the multinationals have Prime Minister Mark Rutte and his government in their pocket, as last week's debate on the abolition of the tax on dividends showed. But things are no better in Brussels. Officials and Commissioners who had to put matters in order following the financial crisis were so intimately linked to the financial sector that very little remained of the original plans and banks and other financial institutions were able to continue their irresponsible speculation regardless.

In the European Parliament there are Members who want to put an end to these conflicts of interest. Via ITCO's work on integrity, we are trying to increase the transparency of lobbying, respond to any transgression of the rules. But in the wake of the Selmayr affair and this latest report from CEO it's high time for lobbyists who don't adhere to those rules to be put in the stocks. You'll shortly be hearing more about this, but with your help we're intending to put the most unsavoury European lobbyist into the limelight by awarding him or her with a prize. This will give them the chance, in the glare of the lights, to explain how, out of sheer greed, they have sold out the public interest.